You May Still Be Owed More Before the March/April Deadlines

Hurricane

Milton & Helene

You May Still Be Owed More Before The March/April Deadlines

Hurricane

Milton & Helene

Request a Free Community Damage Review.

Fill Out the Form Below to Schedule your Free Community Inspection & Policy Review to Receive Your Certificate of Good Condition!

Closed, Denied, or "Below Deductible" Does Not Always Mean Final! Get A Second Opinion Today!

Board Member Reveals How Ask An Adjuster Got Them $1 Million More

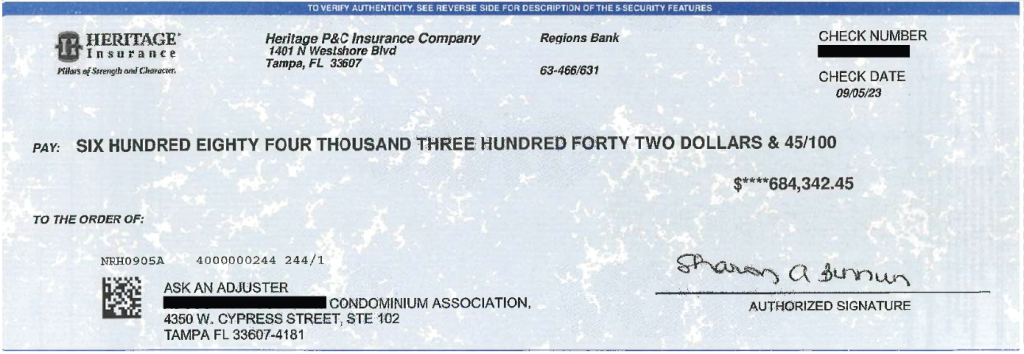

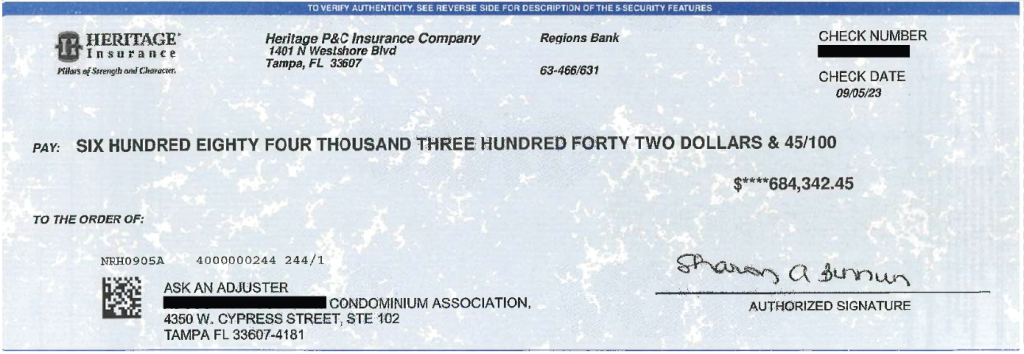

After Hurricane Ian, the insurance company handed Egrets Landing a $1.1 million check and walked away—despite the community facing $3–4 million in real damage. At a CAM/HOA Expo, Harvey met our team member Matt Bigler and quickly realized they needed a true advocate. They hired Ask An Adjuster, and Matt was able to secure an additional $1 million for the association—funds the carrier never planned to pay.

COA President Shares How a Certificate of Good Condition Protected Their Claim

When COA President Susie Heatherington met Ask An Adjuster at a February conference, she requested roof inspections for her 4 condominium buildings. Ask An Adjuster issued a Certificate of Good Condition in May—documenting the roofs were sound before any loss. Just weeks later, the community suffered hail damage, and the insurance carrier pushed back. With the CGC in place, Ask An Adjuster handled the entire claim, resulting in new roofs, new gutters and downspouts, and funds for painting. “I could not have done this without Ask An Adjuster,” Susie said. “Every community association should have a Certificate of Good Condition.”

Closed, Denied, or "Below Deductible" Does Not Always Mean Final! Get A Second Opinion Today!

Board Member Reveals How Ask An Adjuster Got Them $1 Million More

After Hurricane Ian, the insurance company handed Egrets Landing a $1.1 million check and walked away—despite the community facing $3–4 million in real damage. At a CAM/HOA Expo, Harvey met our team member Matt Bigler and quickly realized they needed a true advocate. They hired Ask An Adjuster, and Matt was able to secure an additional $1 million for the association—funds the carrier never planned to pay.

COA President Shares How a Certificate of Good Condition Protected Their Claim

When COA President Susie Heatherington met Ask An Adjuster at a February conference, she requested roof inspections for her 4 condominium buildings. Ask An Adjuster issued a Certificate of Good Condition in May—documenting the roofs were sound before any loss. Just weeks later, the community suffered hail damage, and the insurance carrier pushed back. With the CGC in place, Ask An Adjuster handled the entire claim, resulting in new roofs, new gutters and downspouts, and funds for painting. “I could not have done this without Ask An Adjuster,” Susie said. “Every community association should have a Certificate of Good Condition.”

Fill Out The Form To Schedule Your Free Community Damage Review

Many Hurricane Milton Claims Closed Before All Damage Was Visible or Even Documented!

Free Community Inspection - No Claim Required!

Many Hurricane Milton ^ Helene Claims Closed Before All Damage Was Visible or Even Documented!

Free Community Inspection -

No Claim Required!

Has Your Condo or HOA Suffered Storm Damage?

Don’t Settle for Less Than You Deserve, Uncover Hidden Issues and Know What You’re Owed!

* Expert Claim Reviews – We assess your storm damage to ensure no detail is overlooked.

* Maximized Payouts – Insurance companies aim to pay as little as possible. We fight for what you deserve.

* No Upfront Costs – We don’t get paid unless you do.

Peace of Mind: When Your Inspection Comes Up Clear

Protect Your Property Before Disaster Strikes: The Importance of a Policy Review & Certificate of Good Condition!

Insurance coverage for condos and HOAs can vary—do you know what your policy actually covers? Condo Owner Association policies typically include the building structure and common areas, while Homeowner Association policies may only cover common areas, depending on Florida state laws. A thorough policy review ensures your community is properly protected and helps prevent costly surprises when filing a claim.

Following your inspection, should no damage be found, we will issue a Certificate of Good Condition™.

Protect Your Property Before the Storms Arrive. Don’t risk a wrongful claim denial due to pre-existing conditions.

Fire Damage

Power Outage

Collapse or Decay

Hail Damage

Who Is Responsible

For My Loss?

It’s important to understand what a homeowners and condo association’s policy covers and how that differs from a homeowners or condo owner’s insurance policy.

For any claim questions regarding your Condo/HOA properties, please contact us today for a free review at 877.275.0275.

Who Is Responsible

For My Loss?

It’s important to understand what a homeowners and condo association’s policy covers and how that differs from a homeowners or condo owner’s insurance policy.

For any claim questions regarding your Condo/HOA properties, please contact us today for a free review at 877.275.0275.

7 Reasons

To Ask An Adjuster

1

We are a team of professionals with a construction and insurance background guaranteed to maximize your insurance claim.

2

Your insurance company’s adjuster works for your insurance company and has their best interest in mind, Ask An Adjuster works for you to give you the same advantage as the insurance company.

3

We may be able to deliver a settlement even if your insurance company is no longer in business.

4

We take care of the property inspection process, go over all necessary engineering costs, and assemble all the paperwork to make the strongest case possible for an equitable settlement of your claim.

5

Our services are performed at no out-of-pocket cost to you. Our compensation is contingent on the insurance claim proceeds. No recovery, no cost to you!

6

We have been able to deliver huge sums of money to clients even after they had been told the claim did not exceed deductibles or that there was no damage at all.

7

You may have damage to your structure, windows, or roof that is not visible or you are not aware of. Our expert team will identify deficiencies within your building and assemble the comprehensive claim documents in order to ensure the monies will be available to restore them to a sound, pre-loss condition.

7 Reasons

To Ask An Adjuster

Reason One

We are a team of professionals with a construction and insurance background guaranteed to maximize your insurance claim.

Reason Two

Your insurance company’s adjuster works for your insurance company and has their best interest in mind, Ask An Adjuster works for you to give you the same advantage as the insurance company.

Reason Three

We may be able to deliver a settlement even if your insurance company is no longer in business.

Reason Four

We take care of the property inspection process, go over all necessary engineering costs, and assemble all the paperwork to make the strongest case possible for an equitable settlement of your claim.

Reason Five

Our services are performed at no out-of-pocket cost to you. Our compensation is contingent on the insurance claim proceeds. No recovery, no cost to you!

Reason Six

We have been able to deliver huge sums of money to clients even after they had been told the claim did not exceed deductibles or that there was no damage at all.

Reason Seven

You may have damage to your structure, windows, or roof that is not visible or you are not aware of. Our expert team will identify deficiencies within your building and assemble the comprehensive claim documents in order to ensure the monies will be available to restore them to a sound, pre-loss condition.

You Just

Have To Ask

You Just Have To Ask

Our Expert Public Adjusters

Fill out our contact form, and one of our qualified Florida public adjusters will get back to you to set up an appointment. Our inspection is free, and you don’t pay unless we are successful with a recovery!

How do I know when to contact a public adjuster? Any time you are doing repairs, you should get a free inspection from a public adjuster.